The Monetary Policy Committee of the Central Bank of Nigeria has increased the benchmark lending rate to 26.75 per cent.

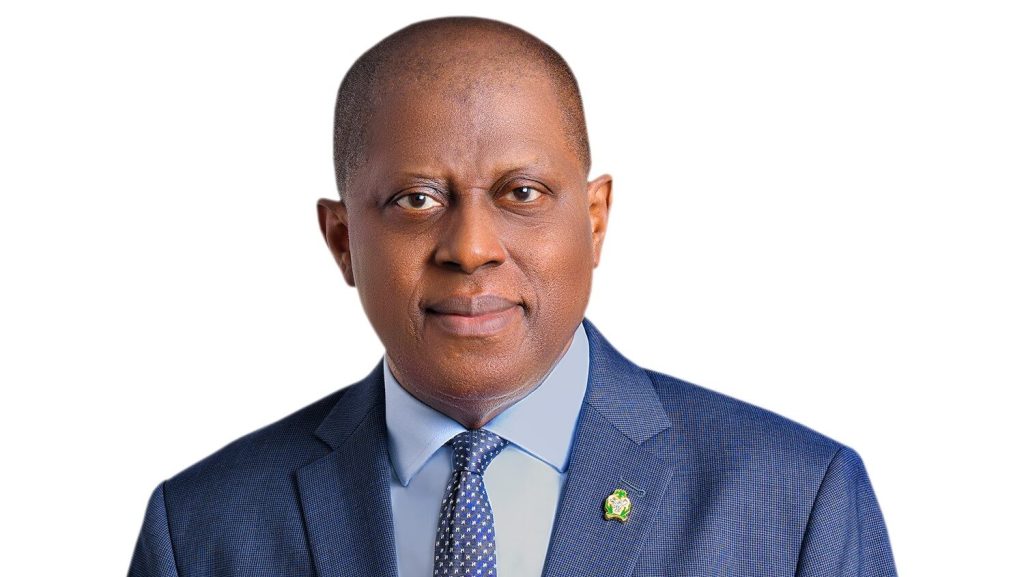

The hike in the Monetary Policy Rate was disclosed by the Governor of the CBN, Olayemi Cardoso, at the end of the 296th MPC meeting in Abuja on Tuesday.

The MPC had maintained a hawkish stance to tame inflation since it resumed meeting this year and thus far, it has hiked rate by more than 500 points.

The rate was raised to 26.25 per cent in May.

However, with inflation moving to 34.19 per cent in June, according to the National Bureau of Statistics, the headline inflation increased by 0.24 per cent relative to the May 2024 headline inflation rate which was 33.95 per cent.

On a year-on-year basis, the headline inflation rate was 11.40 per cent points higher than that of June 2023 (22.79 per cent).

Also, on a month-on-month basis, the headline inflation rate in June 2024 was 2.31 per cent, which was 0.17 per cent higher than the rate recorded in May 2024 (2.14 per cent) meaning that the rate of increase in the average price level was higher in June than in May.

Repeatedly, the CBN governor has maintained that the MPC members were committed to price stability and were willing to keep tightening until inflation is tamed.

Multiple reports from investment houses had projected that the MPR would be hiked.

Cowry Asset Management, in its weekly report, projected a 25bps to 50bps hike in interest rates, while the Meristem report anticipates “a 100 basis point increase in the monetary policy rate to 27.25 per cent while likely keeping other parameters unchanged. Overall, we anticipate that the committee will prioritize inflation control and capital inflow sustainability, crucial for maintaining a stable exchange rate system, and accordingly, implement a rate hike to achieve these objectives.”