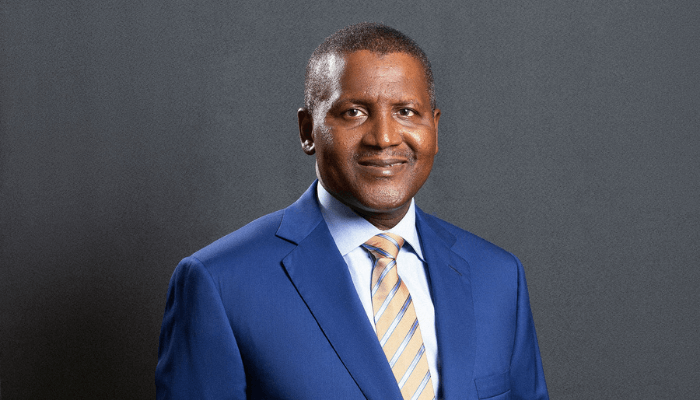

At the 15th Annual General Meeting (AGM) of Dangote Cement Plc in Lagos, Chairman Aliko Dangote announced that the company is preparing for thousands of its delivery trucks to run on Compressed Natural Gas (CNG), aligning with the Federal Government’s initiative to adopt alternative fuels for official vehicles.

Dangote emphasized that this transition supports the government’s efforts to reduce dependency on fossil fuels, enhance Nigeria’s energy independence, and contribute to a secure energy future.

“We are now going to start using CNG vehicles, especially with the new policy of the Federal Government, launched by the Renewed Hope Agenda by His Excellency, President Bola Tinubu.

“By the end of next year, all our trucks that are operating in the company will be running on CNG, and that is a whole lot of money that we are going to invest.

“But we are equal to the task, and we will continue to push and make sure that we continue to make our shareholders happy,” Dangote stated.

In addition, Dangote announced an increase in dividend payouts to shareholders, from ₦20.00 per share in 2022 to ₦30.00 per share for the financial year 2023, reflecting a 50% increase.

He assured shareholders of the company’s commitment to enhancing Return on Investments (RoI) despite economic challenges.

Dangote highlighted the company’s efforts to ramp up production with a new plant in Itori, Ewekoro Local Government Area of Ogun State, projected to have a capacity of 6 million metric tons per annum.

Despite logistical challenges at the Apapa Port in Lagos, the plant is expected to be completed on schedule.

Celebrating the company’s strong performance, Dangote noted a 36.4% increase in group revenue to ₦2,208.1 billion and a 19.2% rise in profit after tax (PAT) to ₦455.6 billion.

Earnings per share increased by 18.8% to ₦26.47. He attributed this success to robust cost control measures and diverse pan-African operations, which now contribute 41.2% to the Group’s overall volumes.

“This outstanding EBITDA performance was underpinned by our robust cost control measures and our diverse pan-Africa operations.

“The latter acted as a cushion, providing resilience to country-specific risks, while the former enhanced our overall profitability. Our pan-Africa operations now contribute 41.2% to the Group’s overall volumes,” Dangote explained.

Group Managing Director Arvind Pathak echoed Dangote’s sentiments, highlighting the company’s diversification strategy.

“Our diverse operations acted as a cushion, providing resilience to country-specific risks. Pan-African volumes were up 12.7% and now account for 41.2% of Group volume.

“Consequently, pan-African revenue increased by a record 123.2% to ₦925.9 billion, while EBITDA surged by over four-fold to ₦263.7 billion,” Pathak said.

Pathak also mentioned the company’s response to inflationary pressures by implementing innovative business strategies, including optimizing the fuel mix and transitioning from diesel to CNG trucks.

Shareholders praised the company’s performance and dividend payout. Mrs. Bisi Bakare, Chairperson of the Pragmatic Shareholders Association, expressed optimism about future dividends given the company’s management during economic downturns.

Dr Faruk Umar, President of the Association for the Advancement of Rights of Nigerian Shareholders (AARNS), commended the board and management for their profitability and sound judgment amidst challenging economic conditions.

Dr Umar also lauded Dangote for his patriotism and dedication to Nigeria, hoping that the price of Premium Motor Spirit (PMS) would decrease with the upcoming production from Dangote Refinery.