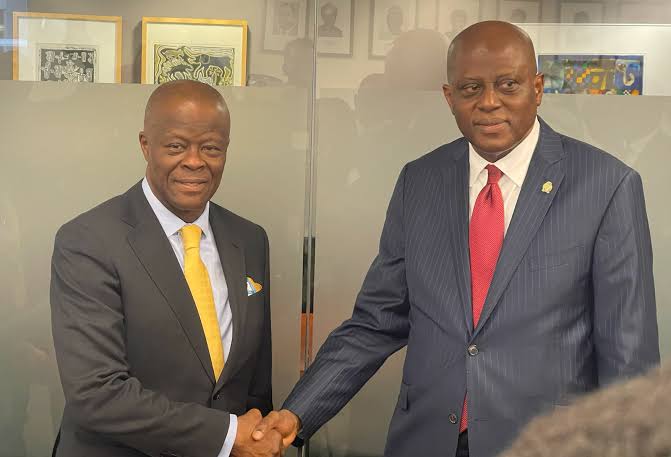

Olayemi Cardoso, the governors of the Central Bank of Nigeria (CBN), and Nigeria’s Minister of Finance and Coordinating Minister of the Economy, Wale Edun, on Wednesday told foreign investors and fund managers that economic reforms embarked upon by the Nigerian government are already yielding fruits.

Premium Times reports that the apex bank governor and finance minister spoke to a group of policy experts, market analysts, investors and fund managers from JP Morgan and other financial institutions on the sidelines of the ongoing IMF/World Bank Annual Meetings holding in Washington DC.

Speaking at the event, Mr Cardoso noted that confidence has returned to the Nigerian market on the back of the tough but necessary reforms being put in place by the present government.

“A situation where interest rate has gone up, we expect that there would be more interest in local currency instruments,” he said.

“Something else that is important in these whole adjustments in the Nigerian economy is the fact that Nigerians would be more inclined to produce locally because it is a lot cheaper for them to do so, rather than depend on imported goods.”

Market Reforms

In his presentation, Mohammed Abdullahi, CBN Deputy Governor on Economic Policy, said that there are moves to ensure that the foreign exchange market does not depend on the apex bank intervention for supply and stability.

Mr Abdullahi noted that the CBN plans to improve supply organically without its intervention from time to time while maintaining balance in the market.

“I think that we are looking at conditions that market return as much as possible to improve supply organically without the Central Bank having to put in money all the time,” he said.

“While you might see us intervene from time to time… we are trying to ensure market is not dependent on the intervention of the Central Bank,” the deputy governor said.

Earlier on Tuesday, Mr Cardoso said the Nigerian Inter-Bank Settlement System (NIBSS) will launch a non-resident Bank Verification Number (BVN) platform to enable Nigerians in diaspora operate their local bank accounts by December.

He explained that the initiative is part of efforts to ensure that Nigerians irrespective of their location anywhere in the world can participate in the Nigerian economy without any hassles and diversify their businesses.

“As far as we are concerned it is totally unacceptable that you should be out here and be having hassles in operating your accounts or doing your business in your original country. I want to tell you that starting in December 2024 Nigerians in the diaspora will no longer face the hurdle of traveling long distances for physical biometric verifications to access financial services,” Mr Cardoso said.

Fiscal Support

Mr Edun on his part noted that prices of petrol and other key oil products are now market-driven, a move that restores confidence in the economy and frees needed revenues to government coffers.

He added that the Nigerian government is also determined to raise oil production to two million barrels a day, as part of efforts to boost revenue.

“The subsidy removal, the fact that the petrol subsidy and the related foreign exchange subsidy are removed means that you can expect, and we will see, a flow of funds into the government coffers. We know that there’s still a demand for foreign exchange.

“In terms of fiscal performance, where we met things was huge debt servicing, costing nearly 100 per cent of revenue and deficit of 6.5 per cent. We got it down so far in the first half of this year, and the debt service to around 60 per cent of revenue, which is still high, but we’re coping with it.

“And by prioritisation, and in terms of the other aspects of fiscal policy, the budget deficit is down to around 4.4 per cent of GDP as of first half of 2024. The target for the year is four per cent, and we are still hopeful of achieving that,” he said.

The minister explained that the commitment of President Bola Tinubu is that while implementing necessary, but wide-ranging reforms, the poorest and the most vulnerable would be protected.

The bills going through the National Assembly would raise VAT for luxury goods, he explained, adding that it will exempt VAT for the essentials and what the poor and vulnerable can purchase.

“Those items would be singled out and exempted from VAT,” he said, adding that VAT for luxury goods will be considered.

There is determination to maintain market price of petrol, Mr Edun said, noting that blockage of leakages would free up resources needed to mordernise the Nigerian economy.