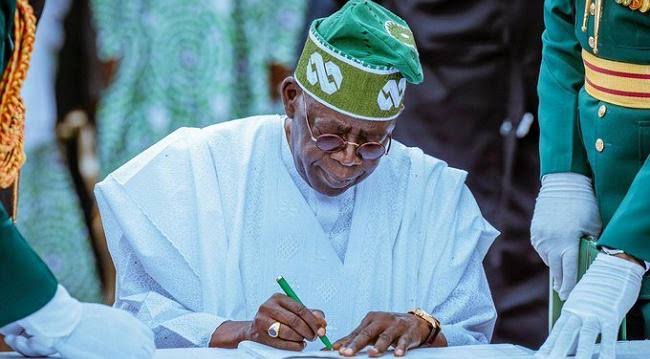

President Bola Ahmed Tinubu has come under severe criticism from the Civil Society Organisations (CSOs) and experts who have opposed his plans to borrow an additional N1.767 trillion.

The CSOs have questioned the Tinubu-led government’s continuous borrowing even as the president has written to the National Assembly, seeking approval to borrow the said amount.

Tinubu is seeking approval for a N1.767 trillion ($2.209 billion) new external borrowing plan in the 2024 Budget (Appropriation Act).

Tinubu’s request was contained in a letter entitled “Request for a Resolution of the National Assembly for the Implementation of the New External Borrowing of N1.767 trillion (About $2.209 billion) in the 2024 Appropriation Act” and addressed separately to the Senate President, Godswill Akpabio and the Speaker of the House, Rt Hon Abbas Tajudeen.

The President said the borrowing was to part-finance the 2024 budget deficit of N9.179 trillion.According to Tinubu, the 2024 Appropriation Act approved N7.828 trillion in new borrowings, of which domestic borrowing stood at N6.061 trillion and new external borrowing was pegged at N1.767 trillion, to part-finance the N9.179 trillion budget deficit.

“The Right Honourable Speaker may wish to recall that the 2024 Appropriation Act approved the sum of N7,828,529,477,860.00 as new borrowings to part-finance the 2024 budget deficit of N9.179 trillion. The total new borrowings of N7.828 trillion was further subdivided into new domestic borrowing of N6.061 trillion and new external borrowing of N1.767 trillion,” part of the letter read. Tinubu explained that the external borrowing funds were needed to give more impetus to the ongoing implementation of the projects and programmes in the 2024 Appropriation Act, which were designed to stabilise the economy and put it on the path of sustainable growth and development.

According to him, key projects to which the proceeds will be deployed include priority sectors of the economy, such as power, transport, agriculture, defence and security while increasing accretions to the external reserves.

Similarly, President Tinubu asked the National Assembly to approve the 2025-2027 Medium Term Expenditure Framework and the Fiscal Strategy Paper (MTEF/FSP) of the Federal Government of Nigeria.The Federal Executive Council had last week approved the MTEF/FSP, which pegged the 2025 budget at N47.9 trillion, the oil price benchmark at $75 per barrel, oil production at 2.06 million barrels per day, an exchange rate of N1,400/$1, and a GDP growth at 4.6 per cent.In a letter, the president asked the House to expeditiously consider the MTEF/FSP as the 2025 budget was prepared based on the document.

The 2025-2027 (MTEF&FSP) was approved during the Federal Executive Council (FEC) meeting on 10th November 2024.

He urged the lawmakers to give expeditious legislative action to the proposal.In another letter, Tinubu requested expeditious consideration and passage of the National Social Investment Programme Agency Establishment Amendment Bill, 2024.

The president said the bill aims at making the National Social Register a primary targeting tool for implementing government social investment programmes.

He said it would ensure that social welfare programmes are data-driven and implementation processes are transparent, targeted, dynamic, and effective in delivering social protection benefits to vulnerable Nigerians.

However, the CSOs that opposed Tinubu’s borrowing plan are the Transition Monitoring Group (TMG), Transparency International (TI), and the Civil Society Legislative Advocacy Centre (CISLAC).Speaking through their leader, Auwal Musa Rafsanjani, the CSOs said the President’s request to the National Assembly for a fresh external borrowing of N1.767 trillion to finance the 2024 budget deficit of N9.7 trillion raises significant concerns.

According to the CSOs, borrowing is not good, given Nigeria’s escalating debt profile.

“Since assuming office, President Tinubu’s administration has borrowed N20.1 trillion, further straining the nation’s fiscal sustainability.

“The Central Bank of Nigeria’s report highlights an alarming rise in debt servicing costs, with $3.58 billion spent in just the first nine months of 2024, a 39.77 per cent increase compared to 2023.“This trend underscores the growing burden of Nigeria’s foreign debt obligations, exacerbated by rising exchange rates and fluctuating oil revenues. Considering these factors and the limited timeframe left in the current budget cycle, approving such a loan may deepen fiscal vulnerabilities without guaranteeing immediate economic relief.

“Efforts should instead focus on addressing structural issues, diversifying revenue streams, and implementing fiscal reforms to reduce reliance on borrowing,” Rafsanjani said.The CSOs said the government must pursue a dual-track approach, combining immediate and long-term measures to address these challenges sustainably.

In the short-term plans, the CSOs said the government must strengthen revenue mobilisation and implement aggressive reforms to enhance non-oil revenue, focusing on expanding the tax base and combating tax evasion.

“Debt Restructuring: The government should engage with creditors to negotiate more favourable terms, such as extending loan tenures and reducing interest rates. Expenditure Efficiency: Prioritise critical sectors while reducing non-essential spending to reduce the budget deficit,” he said.Regarding long-term plans, the CSOs said the government should focus on economic diversification.

“Invest in infrastructure and key sectors such as agriculture, manufacturing, and technology to reduce over-reliance on oil revenues. There should also be exchange rate stability. The government should develop policies that support naira appreciation, including boosting exports and attracting foreign direct investment (FDI).

“On debt transparency, the government should establish an independent oversight mechanism to ensure debt procurement and usage accountability.

“Continuous borrowing without corresponding structural reforms undermines fiscal stability and risks pushing Nigeria into a debt trap. A strategic shift towards self-reliance and fiscal discipline is critical to safeguard the economy and future generations,” the CSOs added.Also speaking, the head of Financial Institutions Ratings at Agusto & Co, Ayokunle Olubunmi, while pointing out that the borrowings, as stated, are part of the plan for implementing the 2025 budget, said the borrowing plan is expected to increase the debt service cost and raise the debt burden on the country.

“However, the maturity of one of the Eurobonds in November 2025 is expected to give some respite, if not refinanced by another borrowing,” Olubunmi said.

For his part, Professor Tayo Bello said that during Buhari’s era, “around 90 per cent of Nigeria’s revenue was spent on servicing debt.

“When this new government came in, we didn’t have complete information on the totality of the debt and the percentage of the revenue we use to service that debt.

“In such a situation, the government has no means of financing the budget other than continuing to borrow heavily, and we don’t even know where we are going.

“If we do not have a rubber stamp National Assembly, the borrowing and spending may be curtailed, but whatever the presidency presents is passed.”