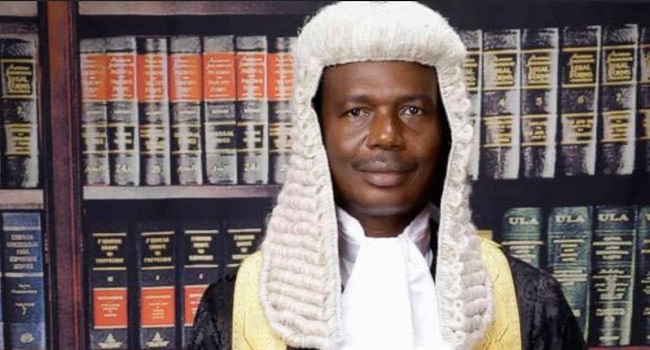

By Ebun-Olu Adegboruwa, SAN

A very dangerous message has been circulating online in respect of the law and practice of administration of estates. Let me repeat it for whatever it is worth.

IS THE CONCEPT OF PAYABLE ON DEATH (POD) LEGAL?

“So ‘Next of Kin’ is useless in the Bank. The real thing needed in the Bank is if you die today, your”Next of Kin” will not have any access to the money in your account!!! So many Nigerians think that their next of kin is the automatic heir to their accounts. But the truth is that if your next of kin is not a signatory to your account, and you don’t have a written Will to determine that person’s legitimacy, the person will not have access to that money at all. Your bank will have to go through a process called a legal probate. This probate period helps them determine who gets the money in your account. This is a very very lengthy and expensive process. Even after the whole process is done, your family will have to forfeit some very reasonable amount of the money for legal fees. But if you want to avoid this, simply request for your bank to give you something called a POD form. POD stands for “payable on death”. The name of the person you fill in that POD form will determine who will get your money. All the person needs to bring is a death certificate to get that money out. With a POD form, you will save your family the stress of going through all that lengthy legal process and even losing some money to the law.”

Nothing can be more worrisome than seeking to bypass the due process of law or seeking to cut corners to achieve a goal by any means possible. The above message must have resonated with many people who see lawyers and the legal process as cumbersome and unduly technical. Nonetheless, it is a dangerous proposition for any one to canvass for adoption by beneficiaries of the estate of a deceased person. By its designation, the concept of POD is outrightly illegal being in direct contravention of existing laws of the land. There are established ways of distributing the estate of a deceased person and POD is not one of them. The idea of POD will throw up many legal issues, if at all it is available for use by any bank or financial institution. By the express provisions of the Administration of Estates Law of many States, the mode of determining the assets of a deceased person is either through a Will or Letter of Administration. The internal procedure of a bank or an institution cannot override the express provisions of the law. There has to be some basis for adopting a financial formula beyond policy and practice. First is the issue of revenue for the government. The owner of the estate must have been paying tax to the government while he was alive, so those who seek to take benefit of the assets comprised in his estate should not employ any crude method that will enable them to evade paying tax to the government. The second is equity and justice. The deceased owner of the estate cannot stand alone, if by his actions he has created others to depend on him, such as wives, children, parents or relatives. His choice of what to do with his assets has to comply with existing laws. For instance, a man cannot on his own decide to give all his assets to his son through the amorphous device of POD if at the time of his death he has a surviving wife or other children. There may be other beneficiaries who may have been excluded from the assets but who are genuinely entitled for one reason or the other. The rule of fairness dictates that all the beneficiaries should submit themselves to a transparent process that guarantees justice and equity. Without any doubt, any bank that releases money or assets to anyone without following the due process prescribed by law does so at its own risk and will be held liable by all beneficiaries of the assets who have been so excluded. The third issue is sustenance of the legal profession. We should not encourage our institutions to short-circuit the law in such a way that may deprive legal practitioners of needed resources. Lawyers are already bearing the brunt of this economy so we should create jobs for young lawyers and not seek to deny legal practitioners of legitimate opportunities to earn their fees. So many of these estates are very large and rich in assets and should be able to afford to pay legal fees. Afterall, the bank where the money is kept is charging interest and other fees. It is a different thing altogether if an estate is not sufficiently endowed to pay legal or other fees, which brings in the concept of waiver by the government or pro bono service by the lawyer. To my mind, a person who wants to inherit an asset should be ready to part with revenue to those who deserve it.

MEANING OF NEXT OF KIN

On February 2, 2024, the Supreme Court delivered a landmark judgment in the case of Ironbar v Federal Mortgage Finance Ltd, which is now reported in (2024) 12 NWLR (Pt.1952) 275; (2024) LPELR-62186 (SC).

Per Ogunwumiju JSC:

“It may be important at this point to consider the capacity as “next of kin” in which the Appellant principally sued. The term, next of kin has been described as the nearest blood relative of a person. See JOSEPH v FAJEMILEHIN O.O. & Anor (2012) LPELR-9849(CA). The term can also refer to a person who can be contacted or notified in cases of emergencies or eventualities. For instance, one of the forms that is usually filled while in transit or in hospitals, requires the information of next of kin. This is needed in case of any accident or death. In other words, where there is an accident or death involving that person, his next of kin shall be notified or informed. The BLACK’S LAW DICTIONARY defines the phrase “next of kin” to mean a person or persons most closely related to a deceased person by blood, consanguinity or affinity. In other words one’s next of kin is one’s relative. It also defines the phrase “next of kin” to mean an intestate’s heirs – that is, the person or persons who may be entitled to inherit personal property from a deceased who has not left a will. In other words a “next of kin” is a family member or one’s relative. The phrase gained popularity during the colonial era because the foreign administrators needed to indicate their “next of kin” in the various forms they filled to ensure that if they died in the colonies, the British government could contact the family through their next of kin as indicated in the employee records. Also, the term is constantly put into use by hospitals. In this case, next of kin means a person who can make medical decisions for a person who is incapacitated or unable to do so, during emergencies. The term is also frequently used in financial documents by banks and other financial institutions. In this instance, next of kin means a person who can ensure that the proper steps are taken towards the recovery of the money held at the bank, at the demise of the owner. In other words, being a next of kin of a person, as regards his money in the bank, does not give a right to inherit such money, either partly or as a whole, it just gives the right to contact the bank and ensure that the money is safe to be properly distributed by the law governing the estate of the deceased.”

The take home from the decision in Ironbar’s case is that being described as a next of kin confers no legal right on the holder of that office beyond formal recognition for the purpose of identifying the assets and to preserve them. If he is otherwise not a beneficiary recognized by law, the title of ‘next of kin’ grants no legal right to him over the estate. And if he is a beneficiary, he still has to go through the procedure prescribed by law for him to step into the estate proper. Human affairs are never predictable, at least in relation to the payment of the compulsory debt that we owe our maker, to leave this world one day, through death. It is an inevitable appointment that everyone must keep, but the issue is always the time of that appointment, which is known to God Himself alone. Because death could come unexpectedly, the law has made provisions for the mode of distribution of the estate of a person who departs unexpectedly without making adequate provisions for the sharing of his or her assets amongst the survivors. The rancours that normally attend this matter have made it imperative to consider it as a topic for discussion. Ideally, the rational thing is for everyone to make plans for the sharing of his assets in a Will, wherein the mode of distribution of the estate of the deceased is well stated, to avoid unnecessary disputes. Even at that, experience has shown that notwithstanding the best of intentions by a testator, people still find reasons to war within themselves, so long as money is involved. In this regard, the estate of a first republic minister is still in court, decades after his death. And two of the best lawyers that Nigeria has ever produced wrote their Wills in such a way that no one would ever have thought of any controversy thereafter, but there have been contentions between their families upon their demise. So, the question then is what can be done to prevent the kind of disputes that attend the distribution of the estate of a deceased person?